The economy is on everyone’s mind. Food prices, gas prices, stock market fluctuations, consumer confidence, etc. So, inflation has been a big part of the conversation in recent months. After a year that almost flatlined the economy, the world got moving again in January of 2021. Yet, the pandemic had shifted a lot of economic factors so that the economy didn’t exactly bounce back to normal. And so the conversations around inflation began, but what does that mean to you as a taxpayer?

As the year comes to a close, many people are wondering what this inflationary rise will mean to them. That’s where tax planning and your tax planning come into play.

What is Inflation?

The term gets thrown around so much that people often lose its meaning. Inflation has wide-reaching implications across the economy, and it refers to the decrease in purchasing power of— in our case— the dollar. That might also be phrased as too many dollars chasing too little goods.

So when there is an influx of dollars into the currency, and there is a shortage of goods, then the “buying power” of that dollar goes down; it can no longer afford the same amount of goods because prices increase. When prices rise as they have been, then people’s dollars are no longer worth as much as they once were. For many consumers, this is a concerning reality.

So, why did prices go up in the first place?

Let’s just say that covid threw a big wrench to the economy, not to mention people’s lives. Not only did covid close businesses but it disrupted supply chains, created labor shortages, created backlogs of necessary materials, which in turn affected the production of materials and goods. The vast interconnected network had several holes in it.

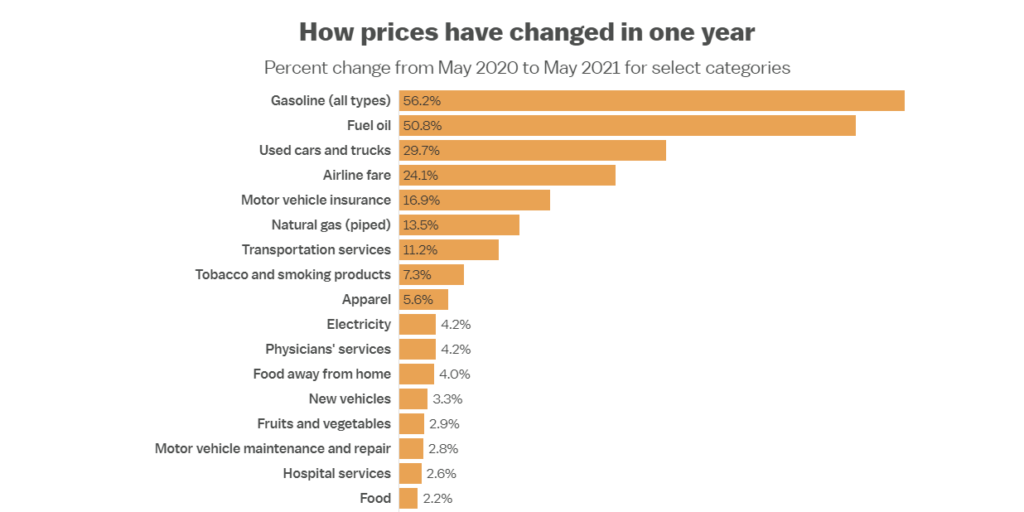

As reported by the Wall Street Journal, inflation hit its highest rate in four decades in the fall of 2021. It was up at 6.8% from years ago. Consumers have seen prices included in everything from vehicles to gasoline, to used cars, airline fare, utilities, clothes, food, and more. The price of lumber to build homes skyrocketed because of a shortage of supplies.

According to a chart posted by Vox, the jump in prices from May of 2020 to May of 2021 showed a 56.2% increase for gasoline, 50.8% for other fuel types, and 29.7% for used trucks.

How Will This Inflation Affect You in Tax Season 2022

When inflation is high, the Fed has to often step in, and there will be changes to the IRS standard deduction, personal exemptions, and even tax brackets.

The Tax Foundation uses this example to put it into context. If a resident in the state of Delaware was making about $60,000 of taxable income in one year in 2019 and is now making 64,000, there has actually not been a rise in income due to adjustments for inflation.

The IRS has boosted the federal income tax brackets for 2022. The IRS announced higher federal income tax brackets and standard deductions for 2022. According to CNBC, the income thresholds for each bracket increased.

In 2022, the standard deduction that is claimed by most taxpayers will increase and rise to $25,900 for couples that file jointly, and for single filers the number will rise to $12, 950.

Other Adjustments for the Tax Season 2022

The changes in the economy have also caused several changes that will come into effect in the 2022 tax season. The alternative minimum tax and an increased estate tax exemption will also change.

The IRS also announced that some workers may also save more on their 401(k) plans in 2022.

Other possible impacts may impact:

- Taking out loans

- Interest rates

- Tax brackets

- Tax exemptions

- Tax bills in some states

Get the Real Story With R&R Taxes

According to The Hill, the inflation tax will not only be large but even larger than the revenues the federal government will collect from individual taxes. The inflation tax is a reality and in 2021, it is considerably large that it has gotten the world’s attention. This has far-reaching implications for people’s financial futures, stability, and decisions. Let us help.

But when it comes down to it, how will this affect your tax bill? Get tax help from the pros.

Go to a tax professional this year and get the right information. Call R&R Tax today.